I don't really know what I should title this post. Perhaps by the time I am finished with it I will know.

This morning I happened to wake apparently right in the middle of considering what I believe to be an imminent financial collapse, the roll of consumer and national debt, the roll of retirement savings on this financial collapse and the very likely reality of massive inflation. It wasn't really a dream, per se, but I guess my mind had pulled together some random facts and there I was asleep and contemplating these matters. Thus I woke.

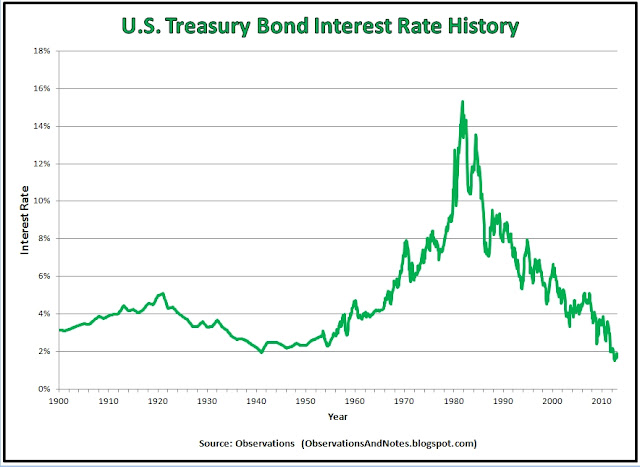

This graph stops at 2010, but we know that near zero interest rates have continued for another six years beyond its scope. Why? Why is the Fed still so worried? We talk about consumer confidence but the interest rate is, in some ways, a measure of Federal confidence is it not?